Insurance termsConsumer Products

On the previous article we explained our motivation for featuring these articles and also started the journey of explaining what insurance is and how it affects each and everyone. In this article we defined what insurance is and described the two main categories of insurance. For those of you who are joining us for the first time and wondering what this journey is all about – as well as those who were with us the last week but still lost as to where we are going with this- we trust sharing with you the following story will be useful in painting a clearer picture concerning this journey we are taking together.

You know when it comes to knowledge concerning insurance matters, some people are sitting on a nail. This journey we are taking together will help to get you off the ‘limited insurance knowledge’ nail!

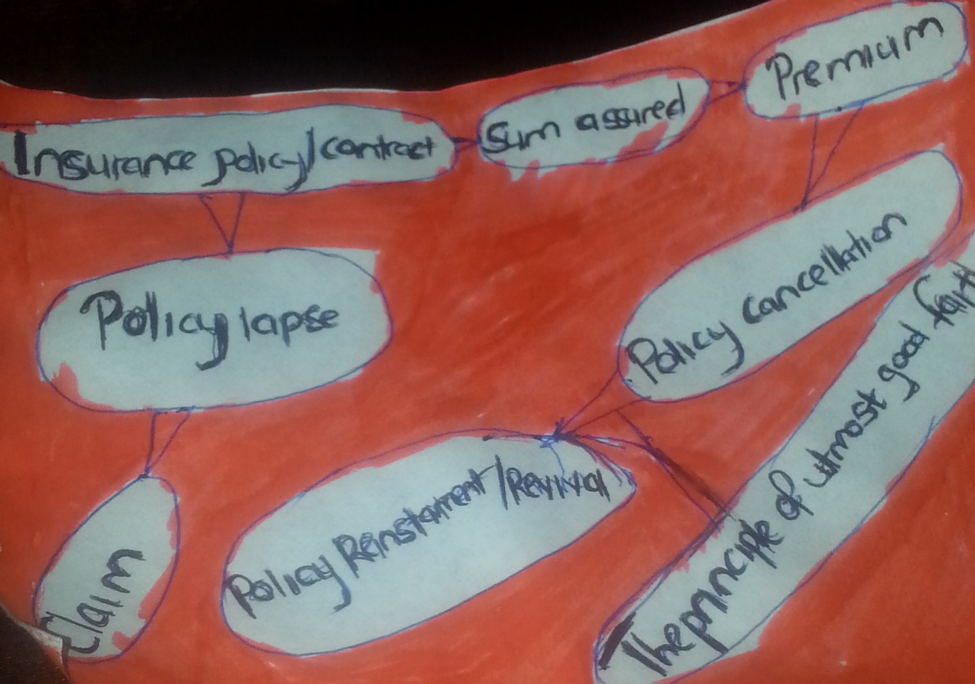

In this article, we will be taking you through some of the most commonly used insurance terms in bold font below- terms you may have come across before or may see in future.

- One

- Two

this is an agreement between the insurer and the policy holder where the insurer agrees to pay the benefits to the policy holder, on certain events, in exchange for premiums paid payable by the policy holder. Policy documents must be studied very carefully and stored in a secure place as they contain critical information.

is the amount of cover provided by an insurance policy. This amount is paid in the event of a valid claim and is usually used in reference to life insurance.

is the amount of money that a policy holder must pay to obtain insurance cover. The amount can be paid as a lump sum or in instalments during the duration of the policy or for a fixed agreed period.

is the termination of cover. It occurs when the policy holder does not fulfill the conditions or requirements set out in the insurance policy; often resulting in a return of premiums to the policyholder.

is the allowance given to a previously terminated to resume active coverage. Depending on the circumstances of the termination and the policy terms and conditions, the policy may be required to compensate the insurer before reinstatement occurs.

is the application to the insurance company for benefits contracted or promised by the insurance company as outlined in the policy document. Policyholders must first file an insurance claim before any money can be disbursed.