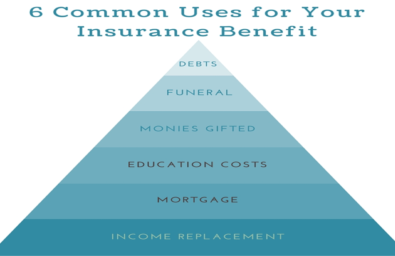

Common uses for your insurance benefitDid You Know? Maizviziva Here?

Insurance benefits

The purpose of insurance s to protects against the effects of losses and damages that could financially impair one’s future. Any insurance relieves policyholders from the financial burden that results from the materialisation of the risk-covered event.

This is a very important of holding an insurance policy.

It helps one cope with hard times and secures the financial state of an individual and/or their dependents at all times. Imagine having to worry about money matters along with the emotional turmoil that comes when life throws us a curve ball.

investment tool

Insurance may also be used as an investment tool. There are savings plans that combine investments and protection elements of insurance. Some part of the annual premium paid by a client will be directed towards investment with the remaining part of the premium providing life cover. So the money grows and in the long-term it can provide healthy returns. For example some insurance plans offer cash-back after a certain premium payment period without affecting the original cover or sum assured.

children's future

Insurance helps you to plan for your children’s future. It can be a great tool to ensure that you receive bulk amounts at pre-determined times of your life or you child’s life. For example, Jonny knows that 15 years from now he will be expected to pay university or college tuition expenses for his child’s higher studies and by taking out an insurance/savings plan that matures 15years from today, Jonny can prepare and plan for the needs of that child.

retirement

What’s more, insurance can be used as a good retirement planning tool. If one does not lock in money every year or every month – chances are that there would be not too much left when one’s source of income dies down. That is when the medical expenses peak. Plan for retirement now and avoid surprises in old age. Do not just keep hoping for the best!

splurge

Ultimately insurance gives one a peace of mind. What better feeling than knowing that one’s family can do without them – not when one is still alive of course! But the very fact that your loved ones need not depend on anyone else, in case of any unfortunate eventuality, is in itself a great relief and one can then live life to the fullest. As long as basic savings are in place, one does not have to agonise when spending on that new car. So go ahead and splurge.

protection

While insurance products will be familiar to most, the beneficial effects of insurance on well-being are often only poorly understood. The basic role of insurance is to increase security at the individual level, protecting individuals from the consequences of extreme events. Insurance helps alleviate poverty in society and helps governments to execute various projects.

There are some of the lesser known functions of insurance, such as contribution to economic development and well-being, its contribution to entrepreneurship and investment, as well as implications for insurance regulation. The added value of the insurance industry has at most an indirect